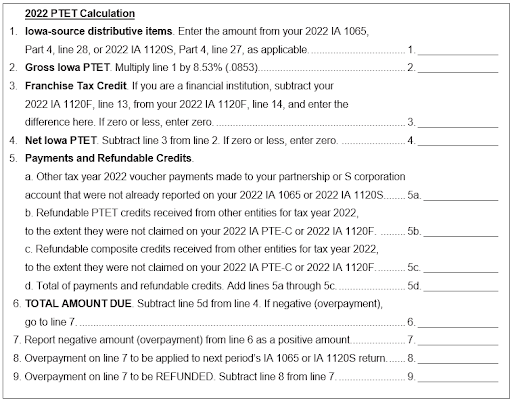

On May 11, 2023, Governor Reynolds signed House File 352 which creates a voluntary election for a partnership or S corporation to be subject to Iowa income tax at the entity level. This is referred to as the Pass-Through Entity Tax (PTET). When the pass-through entity elects and pays the PTET, its owners receive a percentage of the PTET as a refundable tax credit. The legislation applies retroactively to tax years beginning on or after January 1, 2022.

This webpage is intended to provide guidance and answers to frequently asked questions related to the PTET. This page may be updated as the Department adds or refines guidance on the PTET. If you have a question that is not yet answered below, please check back to this page at a later date. You may also submit questions or comments about the PTET through the Request for Tax Guidance (select “HF 352” as the tax type).

References in this guidance to “tax year 2022” generally refer to tax years that begin during the 2022 calendar year, and references to “tax years 2023 and later” generally refer to any tax year beginning on or after January 1, 2023.

Helpful Links

- House File 352

- Tutorial – How to file a 2022 PTET Form on GovConnectIowa

- Webinar - Iowa Pass-Through Entity Tax

- 2022 Iowa Pass-Through Entity Tax Electronic Filing Authorization Form

- 2022 PTET Owners’ Credit Schedule Template

- 2022 Iowa PTET Credit Schedule