If you owe an overdue debt to a public agency participating in the State Setoff Program, the agency may send information about your debt to the program.

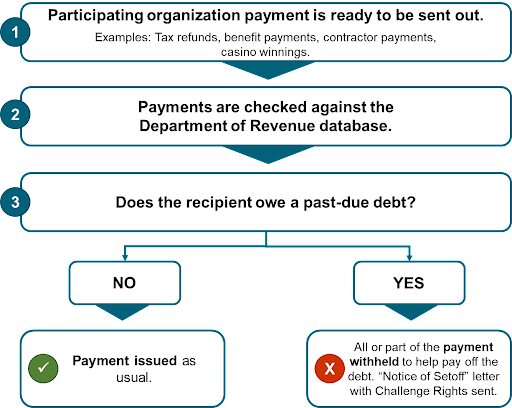

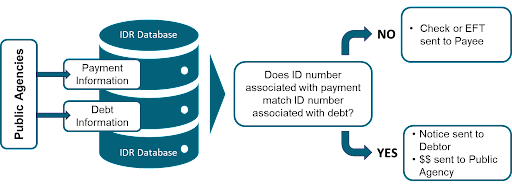

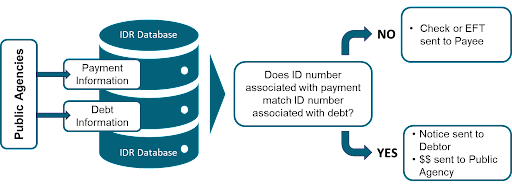

When you are going to receive a state payment or other payment eligible for setoff, a search is performed on the database to see if you have debt placed in the program.

If your debt is in the program, the Department holds back money from the payment to pay your debt. This process is known as a "setoff”.

When the Department takes money from your payment, a letter is sent explaining what we did and providing a challenge opportunity.

What happens before agencies send debt to setoff?

The debt must be “qualifying debt” before it is submitted to the Setoff Program. Processes to ensure that debt is qualifying debt vary by public agency and debt type.

A summary of ”qualifying debt”, as defined in Iowa Code section 421.65(1)(d) follows: Any debt assigned to the Department of Health and Human Services (HHS) or which child support services is otherwise attempting to collect; any debt in the form of a liquidated sum due, owing, and payable to the clerk of the district court; and any liquidated sum certain, owing, and payable to a Public Agency, with respect to which the public agency has provided the obligor an opportunity to protest or challenge the sum in a manner in compliance with applicable law and due process. See 2020 Iowa Acts, HF 2565 for the complete definition.

For example: An agency may require a letter sent to the debtor at the name and address on file for the debt. The requirements of that letter may be to tell the debtor about the debt (type and amount), that the agency intends to refer the debt for setoff, and what rights the debtor has to resolve the debt situation. This letter may provide the debtor opportunities to pay the debt, enter into a payment agreement, or dispute they owe the money to the agency.

Viewing Debt

There are two ways to view outstanding debt. You will need the Letter ID or confirmation number from the letter you received in order to view additional information.

If you were notified about a setoff when you collected your casino or sports betting winnings, visit GovConnectIowa and select View Qualifying Debt for Setoffs.

Setoff Challenge Rights

If you received the Notice of Setoff of Public Payment letter from the Iowa Department of Revenue in the mail, visit GovConnectIowa and select Respond to a Letter. The Notice of Setoff letter explains how to challenge the setoff. You have 15 days from the date of the Notice of Setoff letter to challenge the setoff in writing.

There are three (3) types of challenges:

- Debt is not qualified

- Mistake of identity of the obligor

- Mistake of amount owed

The Department will respond to your challenge within 10 business days from the date the challenge was received in writing.