Iowa Fuel Tax Rate Change Effective July 1, 2024

HF2128 of the 89th General Assembly implemented changes to Iowa Code 452A.3 regarding the taxation of fuel classified as B-11 or Higher and fuel classified as B-20 or Higher to take effect July 1, 2024. The biodiesel B-11 or Higher fuel tax classification is being increased to a fuel tax classification of B-20 or Higher for purposes of excise tax calculations and biodiesel distribution percentage calculations.

The following information is based on the 2023 Retailers Fuel Gallons Annual Report for the determination period beginning January 1, 2023, and ending December 31, 2023:

- Biodiesel B-20 or Higher distribution percentage is 14.61%, which equates to a fuel tax rate for fuel classified as biodiesel B-20 or Higher of $0.295 per gallon, effective 7/1/24.

- The fuel tax rate for biodiesel fuel classified as B-11 to B-19 will be the same as the undyed special fuel tax rate of $0.325 per gallon, effective 7/1/24.

- Ethanol E-15 or Higher distribution percentage increased from 11.12% to 14.76%, now falling in a different fuel tax rate category.

- The fuel tax rate for fuel classified as E-15 or Higher and Alcohol increases from $0.245 to $0.255 per gallon, effective 7/1/24.

- All other fuel tax rates will remain the same.

The Department has updated the deduction rate for blended fuel sales. View the Iowa Fuel Tax Deduction for Blended Fuel Sales for more information for how to calculate that deduction.

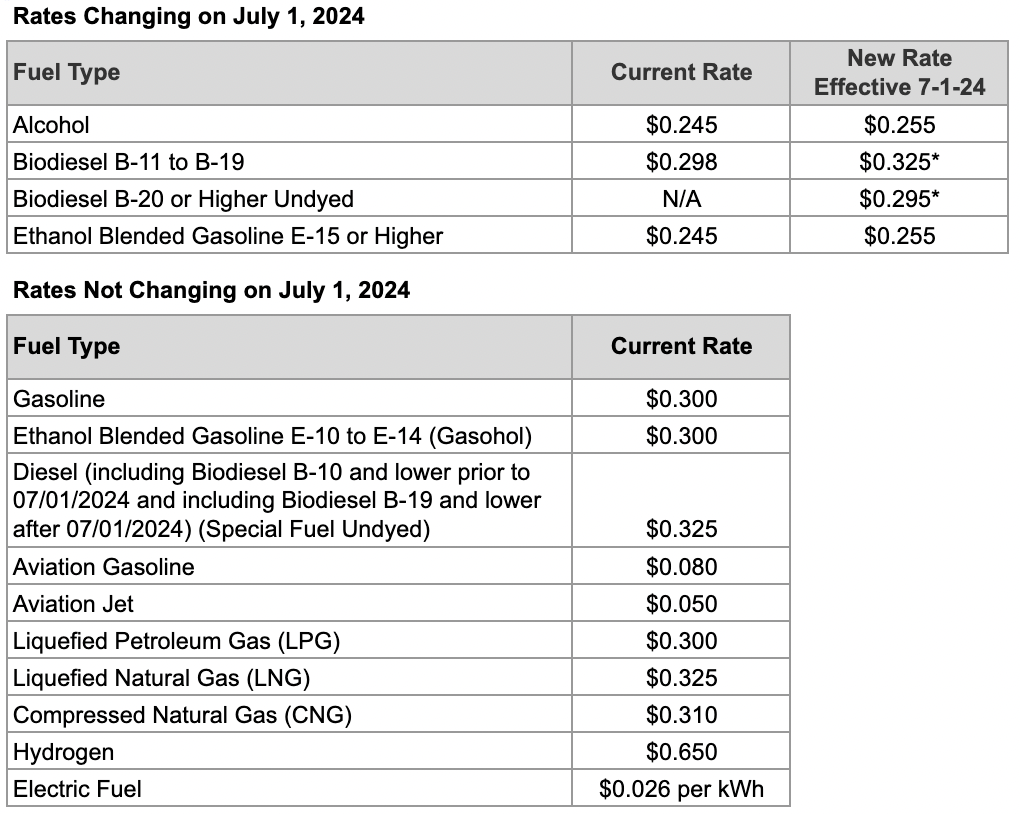

Please refer to the tables below for all applicable tax rates and their effective dates.

You can view the Iowa Fuel Tax Information page for additional information.

*Effective July 1, 2024, the biodiesel B-20 or Higher Undyed is a new fuel group and will replace the biodiesel B-11 or Higher Undyed fuel group to have a lower fuel tax rate. Additionally, biodiesel B-11 to B-19 will fall into the same taxation category as undyed special fuel (diesel).

Claims for fuel tax refunds must be calculated using the correct rates based on the date of purchase. Separate refund claims must be filed for invoices dated for periods prior to July 1, as well as those dated on or after July 1.

Revised Iowa Fuel Tax forms for the period starting July 1, 2024 will be released soon on the Department's Tax Forms Index.